British builders merchants clocked up a bumper quarter in sales in Q1 2022, with the highest ever total sales in the history of the Builders Merchants’ Building Index (BMBI).

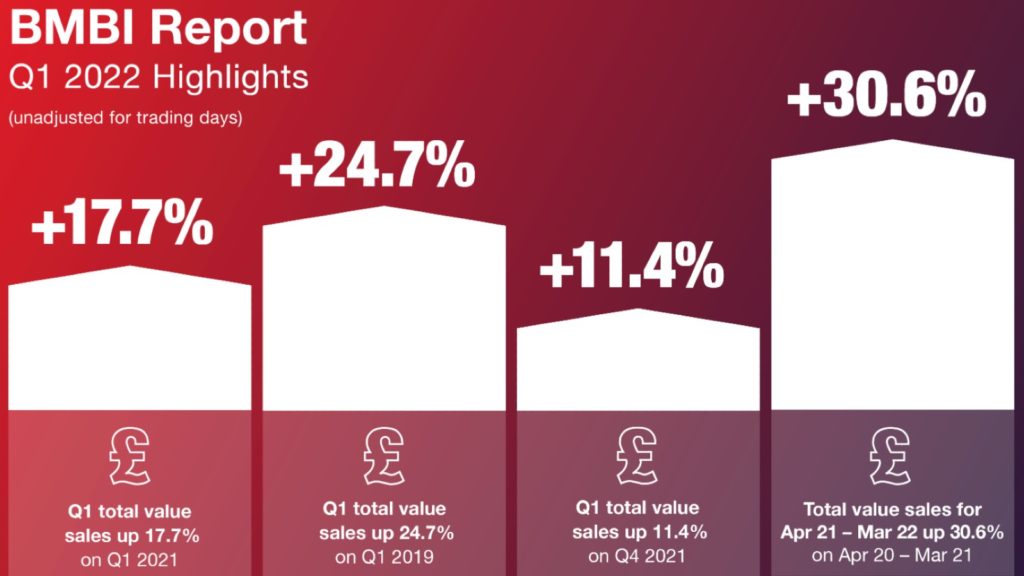

However this was driven by price inflation with value sales up 16.0%, rather than volume growth which was up 1.5%, with quarter 1 2022 total value sales 17.7% higher than Q1 2021

All bar one categories sold more, with Renewables & Water Saving showing the greatest growth at 29.3%, followed by Kitchens & Bathrooms up 26.3%, which also recorded its best-ever quarterly sales.

Sponsored Video

Timber & Joinery Products were up 21.4%, while Heavy Building Materials grew more slowly up 17.4% in value with its volume sales up by 5%.

Plumbing, Heating & Electrical category grew by 16.4% and Miscellaneous was up 12.8%, both of which were their best-ever quarterly sales, while Workwear & Safetywear was flat at -1%.

Comparing Q1 2022 with Q1 2019, a pre-pandemic year, total value sales were 24.7% higher, with no difference in trading days.

All categories sold more including Landscaping up 51.4% and Timber & Joinery Products increased by 40.6%.

Growing more slowly, Heavy Building Materials was up 18.9%, Kitchens & Bathrooms increased by 17.8% and Plumbing, Heating & Electrical grew by 11.2%.

Quarter-on-quarter, sales were up 11.4% in Q1 2022 compared to Q4 2021, helped by three more trading days in the most recent period with all categories selling more and ike-for-like sales were 6.1% higher than in Q4 2021.

March was a bumper month, with total value sales 24.1% higher than February, boosted by three extra trading days in the most recent month.

Seasonal category Landscaping outperformed the other categories at 47.2% growth, while Heavy Building Materials grew by 24.5%. Workwear & Safetywear had the slowest growth of 9.7% . Like-for-like sales were 7.9% higher.

Compared to March 2021, when large parts of the country were again under COVID restrictions, total sales were 9.8% higher in March 2022 with no difference in trading days.

This was driven by price inflation up by 18.5% rather than volume which was down 7.3%.

Eleven of the twelve categories sold more with Kitchens & Bathrooms leading the way up 25.2% and Plumbing, Heating and Electrical grew 16.3%,

Heavy Building Materials was up 10.5%, Decorating grew by 7.8%, Ironmongery increased by 5.9% and Tools rose by 2.8%, all having their best-ever month since the BMBI started in July 2014.

Only Landscaping sold less with a decline of 1.1%.

Total value sales in March 2022 were 35.0% higher than the same month three years ago, helped by two more trading days this year, with all categories selling more and like-for-like sales up 23.3%.

CEO of MRA Research, which produces the BMBI report, Mike Rigby said: “It’s been an uncertain start to 2022 with the outbreak of war in Ukraine further impacting energy costs and inflation.

“But the quarterly figures suggest that – for now at least – the building sector is holding its resolve.

“With rising costs and another round of energy price increases looming, there may be clouds on the horizon but with geopolitical circumstances changeable, there is little way of knowing exactly what Q2 will bring.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and and up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain.