The latest Builders Merchant Building Index (BMBI) report has shown a continuation of “strong” growth in 2021, boosted in part by Kitchen & Bathrooms chalking up its highest-ever BMBI monthly and quarterly sales.

However there are signs of a slowdown in merchant sales as volume growth has given way to value growth, driven by price increases.

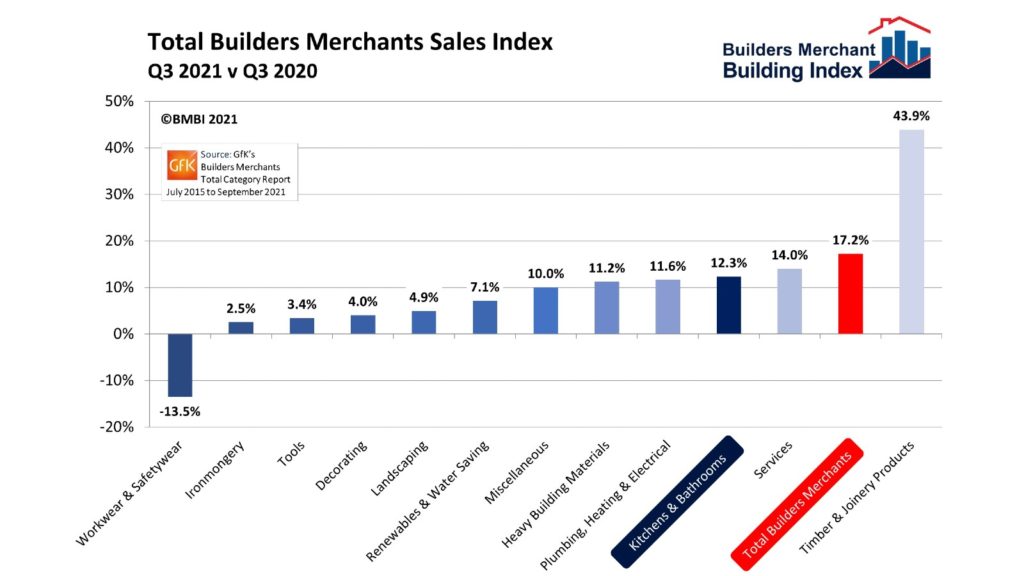

Total value sales in Q3 2021 were 17.2% higher than Q3 2020, with one less trading day this year.

Sponsored Video

Like-for-like-sales increased by 19.1%. Eleven out of the 12 product categories sold more over the period.

Timber & Joinery Products led the field (+43.9%) with its highest-ever quarterly BMBI sales, contributing significantly to overall growth.

The second top performing category was Kitchens & Bathrooms (+12.3%).

Comparing Q3 2021 with Q3 2019, overall value sales were up 18.4% with one less trading day this year.

Timber & Joinery Products were up 48.9%, Landscaping grew by 30.2% and Kitchens & Bathrooms were up 4.3% and among six categories to sell more, with like-for-like sales up 20.2%.

Total value sales for Q3 2021 were down 2.4% compared to Q2 2021, despite the three extra trading days in Q3, with like-for-like sales were 7.0% lower than in Q2.

However five of the 12 product categories sold more in Q3, with Kitchens & Bathrooms performing best up 7.4% and Timber & Joinery up 4.8%.

Total merchant sales in September were 6.2% higher than August, with one more trading day, contributing to Q3’s overall performance.

All bar one category sold more including Kitchens & Bathrooms, with sales up 10.9%.

The Q3 BMBI index was 146.1. The index for Kitchens & Bathrooms was 125.3.

Operations director Lakes Showering Spaces and BMBI’s Expert for Shower Enclosures & Showering Mick Evans commented on the results: “In Q3 we have seen sustained slow growth in our sector, but the stage is set for a bigger finish to the year.

“All the indications are that consumer spending on home improvements will continue for the rest of the year and into 2022, as colder weather brings with it increased interest in indoor projects.

“The value of bathroom projects is going up too. The average bathroom renovation spend was £5,000 in 2020, up a quarter on 2019, according to a consumer survey by Houzz – the home improvement platform.

“Its research revealed that more than half of homeowners were planning renovations this year.

“While we expect 2021 to finish with a flourish, not everything in the industry is positive. Research suggests that one in eight firms fear they will fail within a year as the cost of COVID compliance and surging materials prices squeezes margins, and a shortage of skilled workers is threatening to derail the industry’s recovery as customers wait months for new bathrooms to be installed.

“The British Institute of Kitchen, Bedroom & Bathroom Installation (BiKBBI) is calling for a co-ordinated effort from Government and industry to plug the skills gap but there are no quick wins to fix the problem.

“Bringing new people and new ideas into the industry is essential to future growth, something aptly demonstrated by the increase in bathroom companies utilising digital channels to improve operations and customer satisfaction.

“We have reached a turning point. The pandemic pushed us to embrace digital, and companies who did – by introducing services like online booking, electronic payments and other omnichannel options – are thriving.

“Even if a customer only does their initial product research online, if you aren’t online, you aren’t part of the conversation. It’s as simple as that.

“Can anything spoil the bathroom industry party as we move into Q4 and 2022? Supply chain issues, rising prices, port congestion and the haulage driver shortage will continue, but overall, we are cautiously optimistic.”