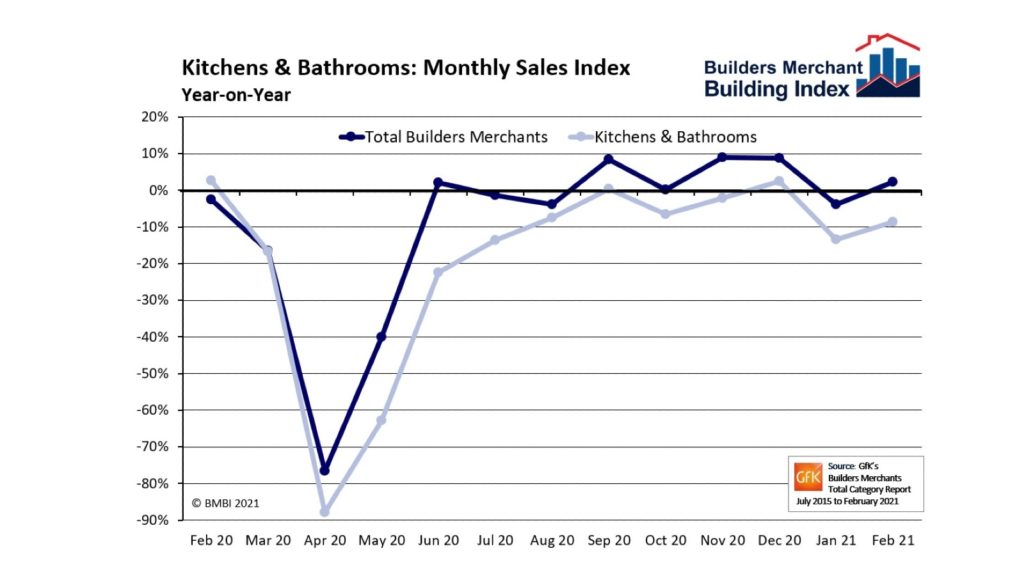

Merchant kitchen and bathroom sales were up “significantly” up in February 2021, with an 13.8% increase on January, according to the latest Builders Merchants Building Index (BMBI) report.

Total Merchants’ sales in February 2021 were 8.6% higher than in January, with no difference in trading days, with Kitchens & Bathrooms the second highest growth category in February at 13.8%.

However indoor trades, which include Kitchens & Bathrooms, Decorating and Tools continue to be affected by the third lockdown and impact of showroom closures.

Sponsored Video

Value sales by Britain’s builders’ Merchants increased by 2.3% in February compared with February 2020, according to the latest Builders Merchants Building Index (BMBI) report.

But only three categories reported sales growth, largely driven by the Timber & Joinery Products category, which surged by 18.2% in February.

Landscaping sales were up 8.6% compared with February 2020, while sales of Tools (+2.0%) also increased.

Sales in the largest category, Heavy Building Materials, were down 1.8% year-on-year, plus Kitchens & Bathrooms (-8.6%), Decorating (-8.4%) and Plumbing Heating & Electrical (-3.6%) all had lower sales compared to February 2020.

Total sales in the three months to February 2021 were 1.8% higher than in the same period a year previously.

Landscaping and Timber & Joinery Products were the top performing categories, while Kitchens & Bathrooms sales were down by 7.3%.

Commenting on the results, CEO of MRA Research Mike Rigby said: “February’s BMBI index demonstrates the strength of the domestic RMI sector.

“The latest ONS figures also show that private housing RMI outperformed every other construction sector in February with 6.7% growth year-on-year, and is one of very few sectors to have recovered above its pre-pandemic level.

“Overall, builders merchants’ sales performance continues to impress and the overall picture is very positive, but the pace of recovery has varied between product sectors, leading to increasing polarisation.

“The Timber & Joinery category, for example, has performed particularly strongly in the first two months of 2021.

“Sustainability is a key driver of demand too, and as householders continue to work from home and invest in garden buildings and other projects, demand will likely stay high for some time.

“On the other hand, the Kitchens & Bathrooms and Plumbing, Heating & Electrical categories were more than 20% below last year’s level on a rolling 12-month basis, as showrooms remained closed in February and householders were reluctant to undertake bigger projects such as replacing bathrooms, kitchens or boilers while being stuck at home.

“However, month-on-month growth in a number of ‘indoor’ categories was encouraging. Latent demand will have a positive impact on Plumbing, Heating & Electrical and Kitchens & Bathrooms sales as restrictions gradually ease, and differences should start to even out.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and a up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain.