Co-founder and CEO of Smileworks Ed Challinor has created an algorithm that predicts revenue, gross profit, costs and net profit for his own business. He explains how to know the difference between margin, mark-up and profit.

The most important business skill is not social media or sales; it’s financial understanding.

Although, knowing how to target your audience is still crucial, as Rob Illidge explains how Facebook can be an effective marketing tool for your business.

Sponsored Video

Newsflash: your accountant doesn’t care about the financial health of your business. The financial health of your business is your responsibility. Their job is to prepare the accounts.

Thinking that paying them £2,000 a year to prepare the accounts is going to magically improve your business performance is madness.

Not having up-to-date financials is like trying to drive a car with a blindfold on. Tiny mistakes can lead to huge problems around the corner.

Margin vs. mark-up

The difference between margin and mark-up is very simple. They are both looking at the relationship between ‘sales and cost’ or ‘income and gross profit’ from two different points of view.

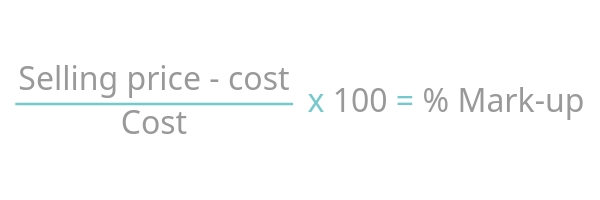

In retail, mark-up is simply the difference between what you buy something for and what you sell it for. So: Mark-up helps you decide on a price to sell something at, or to adjust the price if things start going south and you are either not selling enough or selling too much, too cheaply.

Mark-up helps you decide on a price to sell something at, or to adjust the price if things start going south and you are either not selling enough or selling too much, too cheaply.

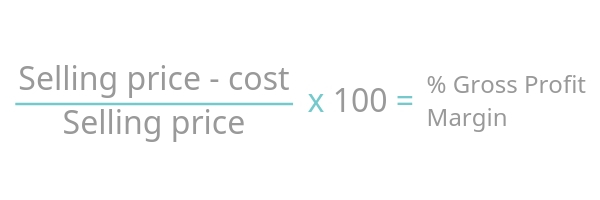

Whereas, margin is looking at the same two numbers (income and gross profit) but it uses the price as the denominator in the calculation.

It looks at the gross profit as a percentage of the selling price. So, it’s looking at things not from the supplier’s direction but from the buyer’s. So: Things get complicated when you are in a services business because your cost of goods sold includes variables like contractors, showroom and marketing costs.

Things get complicated when you are in a services business because your cost of goods sold includes variables like contractors, showroom and marketing costs.

Put simply, you need to spend this money (i.e. buy the products, marketing and labour) to make the revenue.

Some businesses will put their marketing in fixed overheads or maybe put some contractors in their fixed costs if they are spending the same amount on them each month or quarter.

So, it’s up to you where certain costs go on the P&L and gaining financial clarity is about finding out where certain costs should go.

This give you the best chance of attaining an accurate picture to calculate profits and optimise for the creation of cash.

Also, if you’re using gross profits as your numerator in these calculations then you’re potentially heading for trouble because you’re not taking into account the fixed overheads required to run the business.

These include things that are broadly the same each month no matter how much revenue you generate. Fixed costs might be electricity or rent payments.

These stay the same each month so are easy to forecast. But just because they are constant doesn’t mean they should be ignored.